Budget and cash flow forecasting advisory

We navigate the numbers, so you can focus on what you do best.

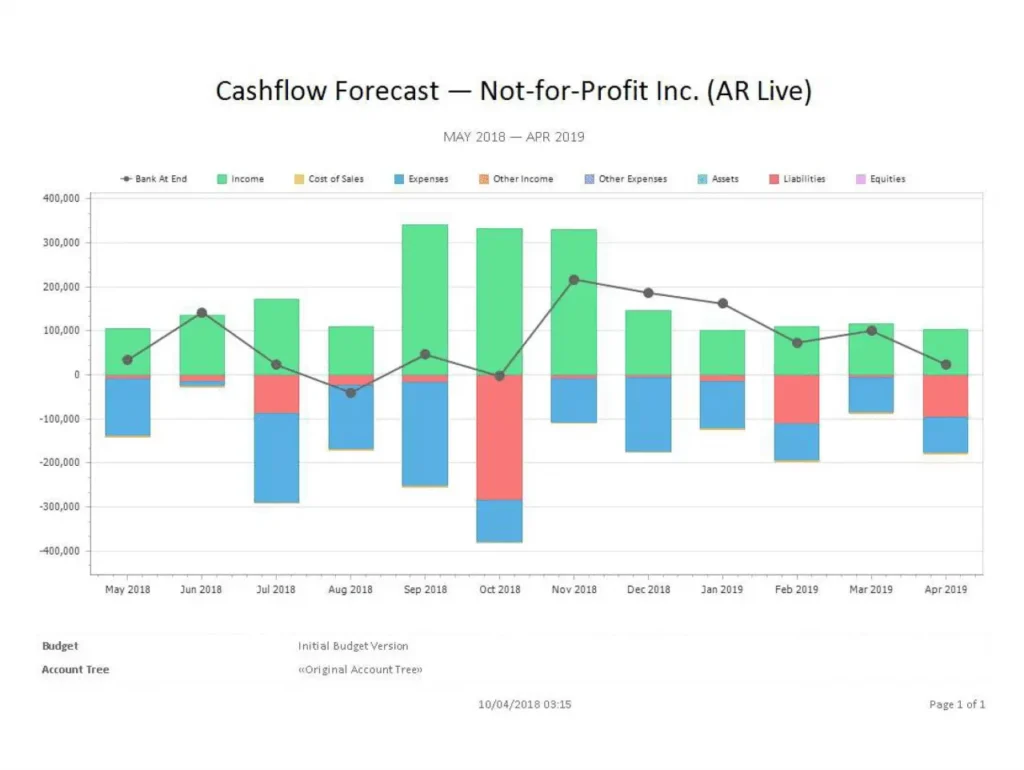

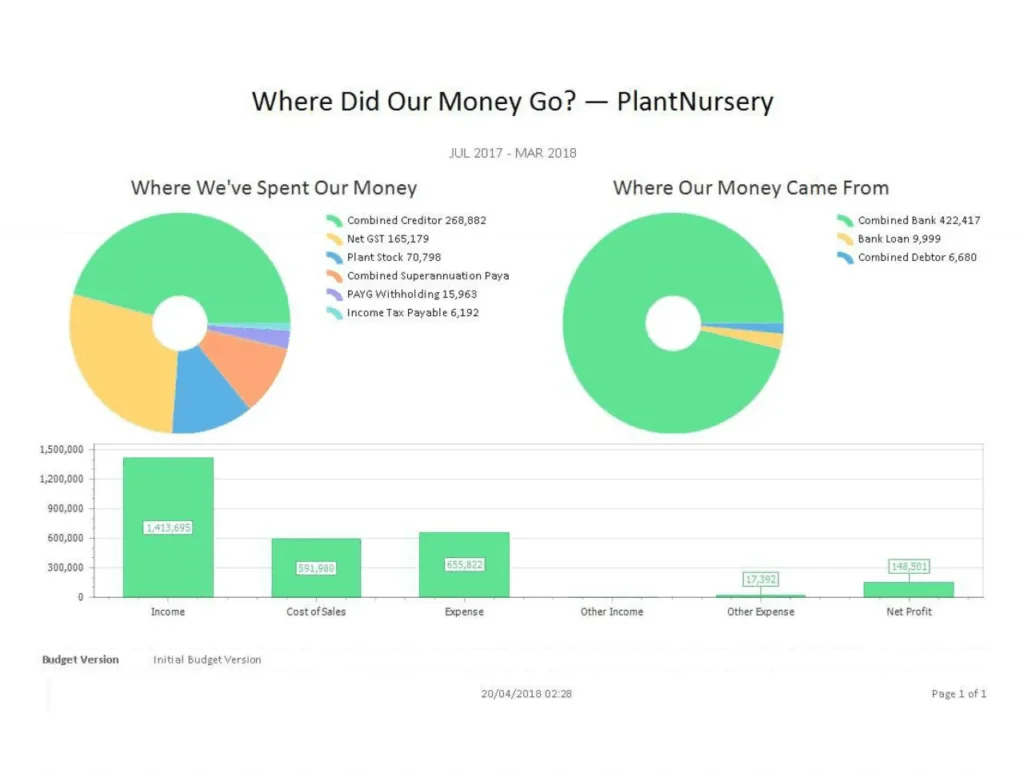

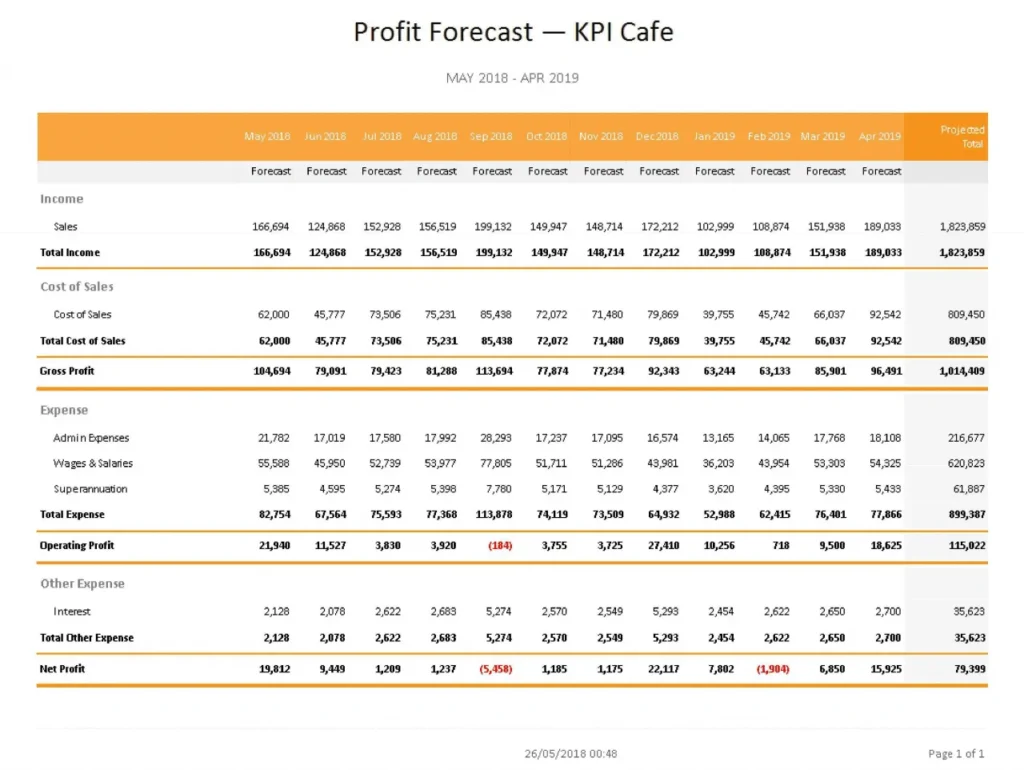

Cash flow forecasting is the backbone of every thriving business.

We go beyond just numbers on a spreadsheet. It’s about knowing exactly when cash will flow in and out, allowing you to plan ahead, seize growth opportunities, and avoid any unexpected financial surprises. With regular updates and easy-to-understand reports, you’ll always know where you stand and what steps to take next.

After all, having a clear view of your cash flow isn’t just smart – it’s essential for a successful business. Whether you’re looking to expand, manage seasonal fluctuations, or simply want peace of mind, our proactive approach helps you stay in control and make informed decisions with confidence.

MEANINGFUL SUPPORT

Expert advice and support without the hassle

Truthful communication with the jargon

We believe in honest communication without the jargon

Our goal is to make your cash flow easy to understand, so you’re never left guessing what the numbers mean. We cut through the technical language and provide straightforward explanations, giving you the clarity you need to make informed decisions. Whether it’s a quick chat or a deep dive into your financials, we’re here to talk in plain terms that make sense to you. With Wardle Partners Accountants & Advisors, you can count on real conversations and advice that’s as clear as it is valuable.

Real people who want you to grow and succeed

You’re not just another client — you’re a valued partner

Our team is made up of real people who genuinely want to see your business succeed. We’re passionate about helping you achieve your goals and take the time to understand your vision and what drives you. We’re here to support you every step of the way, offering guidance, insights, and a friendly ear when you need it most. With us, you get more than just numbers; you get a team that’s truly invested in your success and committed to making your life easier.

Ready to gain clarity on your cash flow?

Have a clear view of your cash flow

If you’re tired of the uncertainty and want a clear view of your cash flow, let’s start a conversation. With our expert team by your side, you’ll have the confidence to make bold moves, knowing exactly where your finances stand. Whether you’re gearing up for growth, managing the day-to-day, or preparing for the unexpected, we’re here to help you navigate the path ahead. Reach out today, and let’s make your cash flow work smarter for you.

Transiting from your existing accounting

Smooth and hassle-free transition

Switching accountants can feel daunting, but we make the process as smooth and hassle-free as possible. Our dedicated team handles the transition from start to finish, working closely with you to understand your current setup and ensure all your financial information is transferred securely and accurately. We communicate every step of the way, so you always know what’s happening and what to expect.

The people who make it hapen

- Loyal, long-standing team

- Big enough to deliver, small enough to genuinely care

- Friendly, proactive team that feels like an extension of your business

We know your time is valuable

Let us simplify your cash flow and help you stay ahead. Contact us now.

Office Address

8 Otranto Ave, Caloundra QLD 4551

Phone Number

07 5492 0300

Business Hours

Mon-Thurs: 8:00am - 4:30 pm

Friday: 8:00am - 2:00pm